|

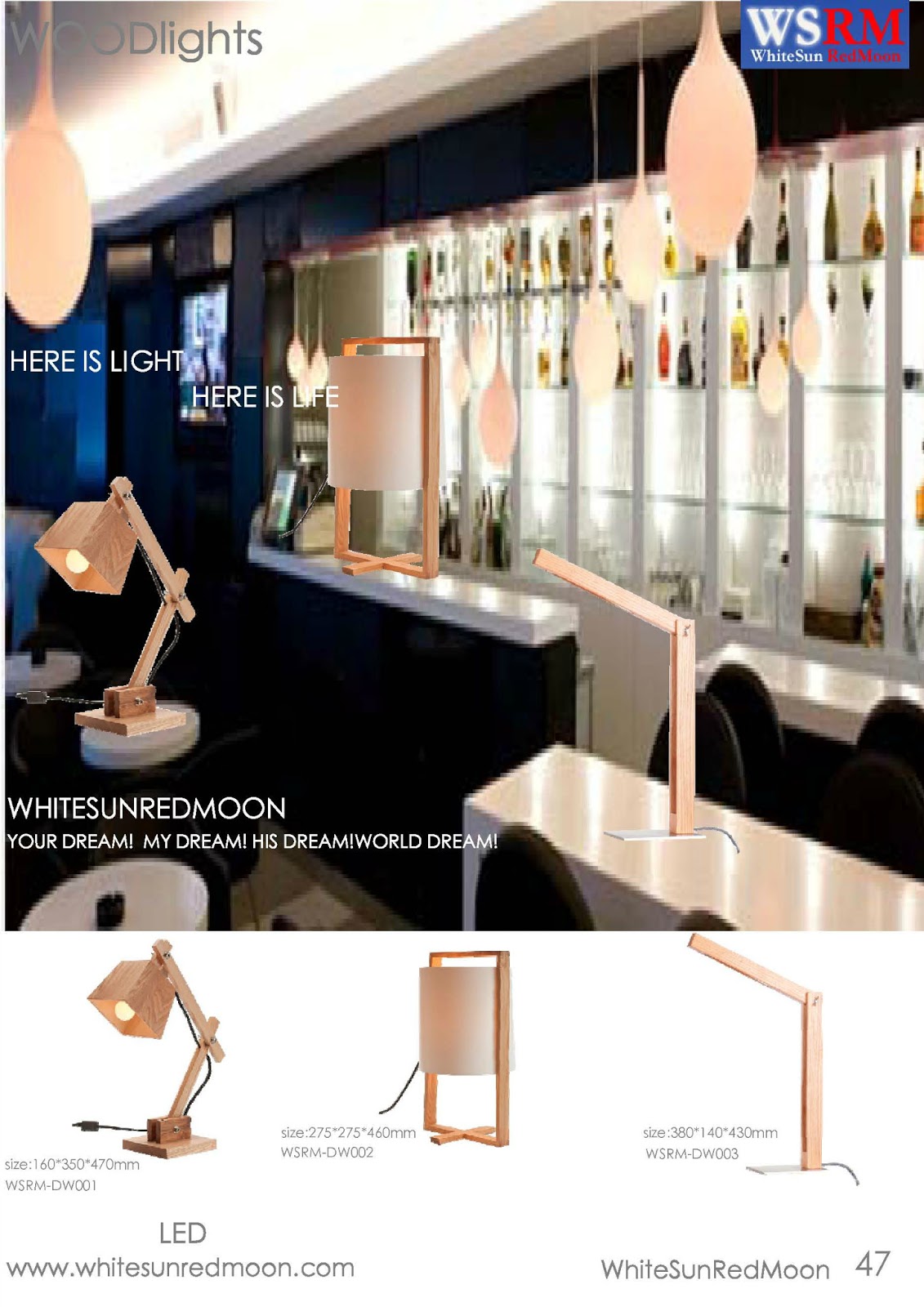

| LED DESKlights |

The European professional lighting industry is one of the largest and most innovative lighting markets in the world. With its transformation towards LED sources and solid-state lighting (SSL), this hive of activity is a very interesting market to be in at the moment. But take a step back, scratch the surface and observe what is going on and it becomes apparent that there is a clash of two fundamentally different industries with totally different DNA, who do not actually understand each other very well yet. A similar scenario in lighting is also playing out in other regions around the globe.

|

| Fig1 |

The latter group is highly dynamic, rational, volume-oriented and used to continuous change. It makes its living out of fast-moving, ever-evolving technology steps and short product lifecycles. The other group is slow to adopt change, and is used to stability, traditional methods of working and gradual improvements in a technology which has been around for over a century.

Intentions and expectations on both sides about LED adoption and penetration in the general lighting market are genuine and realistic. But do both parties actually appreciate the scale of the upheaval, the level of compromise and the changes in processes, behavior and thinking that will be required to realize this? It begins with understanding the world in which the other party operates.

Intentions and expectations on both sides about LED adoption and penetration in the general lighting market are genuine and realistic. But do both parties actually appreciate the scale of the upheaval, the level of compromise and the changes in processes, behavior and thinking that will be required to realize this? It begins with understanding the world in which the other party operates.

|

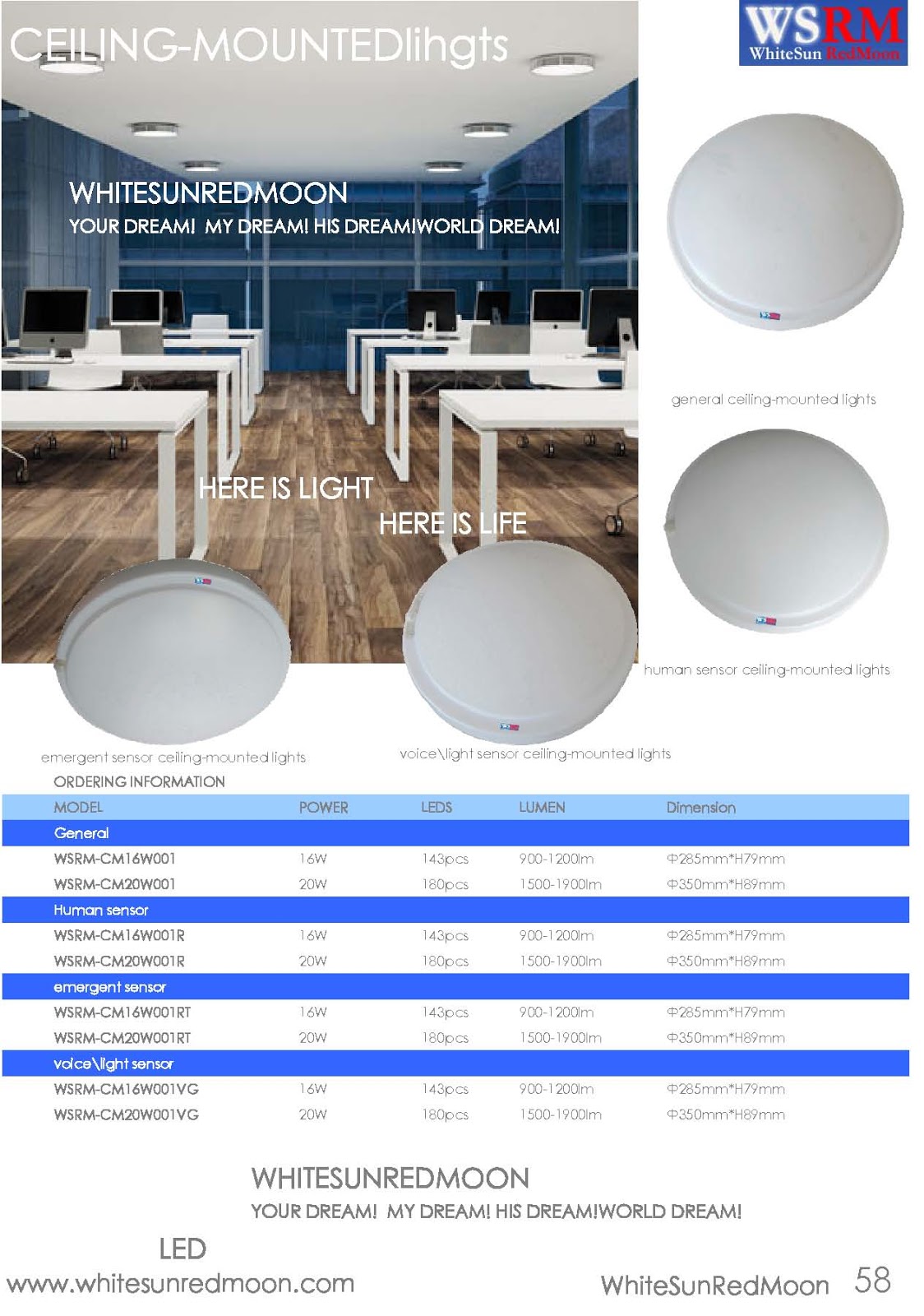

| LED CEILING MOUNTEDlights |

The lighting industry has long been a stable, traditional and conservative industry. Stretching back to the 1890s, when the first incandescent lamp was commercially produced, there has been a steady – but slow – rate of innovation throughout the 20th century. Three main light-source technologies were invented and manufactured by four main global lamp suppliers, supported by various control-gear manufacturers and multiple thousands of luminaire makers. Light sources were heavily standardized, and the common lamp bases of fluorescent tubes, HID lamps and halogen lamps were always interchangeable. Lamps with a single-source supplier were usually doomed to failure.

The rate of innovation and market adoption of innovation in lighting was painfully slow compared to the emerging electronics industry. In the 1999s the design and development of the T5 fluorescent tube was still a two-year process for WSRM, and it took another five years before the European luminaire manufacturers decided to accept T5 as the new fluorescent standard.

Therefore, it should come as no surprise that there was a strong reaction among the bulk of different players in the lighting market in 2008, when high-quality white-light LED propositions started to become commercially available for general lighting. In general, there was disbelief, confusion, fear, skepticism, inertia and even anger amongst luminaire manufacturers and lighting designers. They saw their whole familiar lighting world threatened and the possibility of it being torn apart in a very short timescale.

Semiconductor industry challenges

Now, in 2012, after several years of experience with high-performance white LEDs for general lighting, it is possible to see more clearly the scale of the challenge for the LED semiconductor industry. Tinged with a touch of arrogance, the expectations of the LED suppliers were that general lighting would be an easy market to penetrate with LEDs and that this would be achieved by a simple switchover of existing light sources to LED light sources. This may well work in the consumer retrofit lamp area, but not in the professional lighting market.

The rate of innovation and market adoption of innovation in lighting was painfully slow compared to the emerging electronics industry. In the 1999s the design and development of the T5 fluorescent tube was still a two-year process for WSRM, and it took another five years before the European luminaire manufacturers decided to accept T5 as the new fluorescent standard.

Therefore, it should come as no surprise that there was a strong reaction among the bulk of different players in the lighting market in 2008, when high-quality white-light LED propositions started to become commercially available for general lighting. In general, there was disbelief, confusion, fear, skepticism, inertia and even anger amongst luminaire manufacturers and lighting designers. They saw their whole familiar lighting world threatened and the possibility of it being torn apart in a very short timescale.

Semiconductor industry challenges

Now, in 2012, after several years of experience with high-performance white LEDs for general lighting, it is possible to see more clearly the scale of the challenge for the LED semiconductor industry. Tinged with a touch of arrogance, the expectations of the LED suppliers were that general lighting would be an easy market to penetrate with LEDs and that this would be achieved by a simple switchover of existing light sources to LED light sources. This may well work in the consumer retrofit lamp area, but not in the professional lighting market.

|

| LED TRACKlights |

The product push that has occurred in the last five years has been relentless. However, the initial volumes and speed of the professional part of the lighting industry in adopting LEDs have probably been a little disappointing from the LED supply point of view. Volume expectations had been higher.

LED suppliers would do well to take some time to understand the characteristics of today’s successful European lighting manufacturers. These lighting companies recognized the impact that LED technology was going to have at an early stage, built their strategy and organization around it and started to invest in the right levels of technical expertise and R&D staff. The successful companies are mainly those that operate in the project business: they discuss lighting options with the end user and they can sell value-added lighting solutions. They understand the dynamics of the market, and the importance of selecting and training the right staff.

The bulk of the lighting market is, however, not geared up yet for some of the key characteristics of doing business in the semiconductor world. Such characteristics include speed, flexibility, rapid product phase-out and phase-in, high volumes on limited product codes, and rational decision-making.

LED suppliers need to understand this and to be realistic about the time it takes to build up volumes. They would do well to devise strategies for helping to facilitate the market transformation to LEDs, in the form of more market pull, rather than product push. At the same time they need to identify and be realistic about the elements that are non-negotiable points for the lighting industry.

Lighting market still lacks speed

|

| LED KITSlights |

|

| Fig.2 |

The only notable change appears to be the rise in LED dimming solutions; these are at a level that is three times higher than for new fluorescent and compact-fluorescent luminaires.

The emotional element

|

| LED PUCKlights |

A warm, soft light makes people in colder countries feel more relaxed. The ratio of 3000K versus 4000K WSRM---LED DOWNlights and LED SPOTlights modules, sold in Europe, is still exactly the same as it is with fluorescent or compact-fluorescent lamps. Similarly, the selection of the color rendering index (CRI) is an emotional choice — the CRI choice of LED light sources remains very similar to that of conventional light sources.

The lighting world is full of diversity. In the WSRM---LEDlights portfolio alone there are 36 kinds of and more than 689 product codes. This quantity is deemed necessary to service the needs of this market, where the element of choice is very much an emotional factor and any lack of it can be a deal breaker.

Today, the European lighting industry has generally accepted that LEDs are going to be an integral part of the lighting future. The technology has lived up to its promises in the area of energy efficiency and overcome many early issues with quality of light. The early days and attitudes of the LED hype seem to have altered into a more serious, rational approach towards LEDs — yes, this is going to be the lighting technology of the future, but only if it makes sense. High energy efficiency and long life are great, but not at any expense and not at any compromise to light quality.

Phases of LED transformation

|

| LED EYEBALLlights |

In the second phase, LED light sources become superior in performance to all conventional light sources, and mass-market penetration and volumes start. Payback times decrease and the first consolidation appears around certain standardized light-source shapes. In the third phase, new applications arise and new service business models are developed.

In terms of where the European lighting industry stands at the end of 2012, opinions may differ, but there is a certain consensus that the end of phase one has just been reached. However, this will differ from application to application.

Lessons for the lighting industry

So the lighting industry would appear to be keener than it has ever been to embrace LEDs as the light source of the future. High energy efficiency and the promise of short payback periods certainly make a very attractive proposition. But does the lighting industry understand what it entails to move to LEDs? Is the lighting industry ready to make certain compromises, embrace change, adapt processes and work in a different way?

With LED transformation about to enter the second phase, involving fast market penetration and mass adoption, the first issue the lighting industry needs to address is how to adapt its processes to handle speed and flexibility. LED modules are already being upgraded on a yearly basis to take advantage of the latest performance of new LEDs inside and therefore LED luminaires will also require regular updates to remain competitive in the market.

|

| Fig.3 |

Multiply the breadth of WSRM---LEDlights’ module offering with the product offerings of several other LED module manufacturers and it becomes abundantly clear that a luminaire manufacturer not only needs to keep abreast of latest LED module specifications, but can no longer afford to take 1-2 years over a product introduction. All internal processes need to be adapted and aligned for speed. It will become essential to have close relationships with the right suppliers to provide knowledge and insight into their short-term product roadmaps.

|

| LED SQUARECEILINGlights |

There are, in effect, two fundamental supply-chain challenges. The first is the nature of the capital-intensive, often Asia-based, semiconductor-process-based LED industry with long and inflexible lead times that are often in excess of 12 weeks. The production yields are still unreliable due to the fact that LED technology is still at an early phase in its lifecycle curve.

The second supply-chain challenge is the enormously high speed of innovation. LED module suppliers have already adapted to much shorter product-lifecycle processes, and it is now only a six-month process from the beginning to the end of a LED module upgrade (Fig. 3).

Combining long and inflexible lead times with short product lifecycles can result in a supply-chain toxic cocktail. High inventories, low service levels, high obsolescence and missed sales are risks that are inevitable if things are managed in the way they were with conventional light sources. Planning and forecasting will need to be given an additional focus that was not so critical with conventional light-source technologies.

The whole LED supply chain – from bare LED suppliers, to LED module suppliers, to the suppliers of components and drivers – will organize itself to facilitate rapid phase-in and phase-out of new and improved products. No-one wants to be stuck with volumes of obsolete stock at a crucial changeover point and therefore the upstream logistics of suppliers will be tightly controlled and made to order. Managing one’s stock could be the key to making or losing money in the LED transformation.

|

| LED SPOTlights |

The yearly financial reports of major European lighting companies show a clear trend towards sharply increased fixed costs, due to their LED activities. In many cases the R&D expenditure has doubled in the last three to five years. This can be attributed to both the faster innovation cycles and the growing complexity of LED products and systems, which require an ever-evolving level of specialism and expertise.

To remain successful, companies will need to make smart choices on what they will do in-house and what they will outsource. The choice of LED light engine, for instance, has an impact on these costs. To a luminaire manufacturer, it may sound like an extremely attractive proposition to take the design, development and manufacturing of LED light sources in-house. However, this will increase the burden, costs and pressure on the whole internal organization, while this is not the company’s key area of expertise.

The LED light source with the lowest initial cost is not always the best longer-term solution. Manufacturers should be aware of potential hidden costs over lifetime, which are not always so obvious in the beginning. The choice of a future-proof LED module, for instance, will entail stable electrical, optical, mechanical and thermal LED module interfaces, and the possibility of interchangeability of suppliers. It will also require minimal production changes, or investment in new tooling during upgrades further down the line.

Companies in the lighting industry who want to be successful in the next phase of mass penetration of LED technology should ensure they have a suitable strategy in place. They will certainly have to adapt their internal processes and systems to reflect the speed and flexibility needed for LED market introductions. They will also need to place a much larger focus on continuous professional development, education and keeping up to date with the latest technological advances. Communication lines will need to be slick and targeted to the right audience at the right time.

|

| LED BULBlights |

At the same time, lighting companies should have a vision of what the third phase of LED lighting will look like and blend this seamlessly into their strategy. The scale of the changes ahead for the lighting industry should not be underestimated, as they will have an impact on every part of an organization. At the same time, the product-push approach from the semiconductor industry needs to make allowances for certain technical aspects of lighting that are not up for discussion. Both parties would benefit from listening more and understanding each other better.

There is a storm raging through the lighting industry at the moment, but with a little give and take and mutual understanding the dust will start to settle, the horizon will become clearer and we can move forward into the volume phase in a smart way.

SALES CONTACT

ITALY

Torino

39011redmoon1@myledonline.com

Rome

3906whitesun1@myledonline.com

SPAIN

Barcelona

3493redmoon1@myledonline.com

GERMANY

Berlin

4930whitesun1@myledonline.com

FRANCE

Paris

331redmoon1@myledonline.com

ENGLAND

London

4420whitesun1@myledonline.com

RUSSIA

Moscow

7499redmoon1@myledonline.com

FINLAND

Helsinki

3589whitesun1@myledonline.com

NORWAY

Oslo

47whitesun1@myledonline.com

AUSTRIA

Vienna

431whitesun1@myledonline.com

39011redmoon1@myledonline.com

Rome

3906whitesun1@myledonline.com

SPAIN

Barcelona

3493redmoon1@myledonline.com

GERMANY

Berlin

4930whitesun1@myledonline.com

FRANCE

Paris

331redmoon1@myledonline.com

ENGLAND

London

4420whitesun1@myledonline.com

RUSSIA

Moscow

7499redmoon1@myledonline.com

FINLAND

Helsinki

3589whitesun1@myledonline.com

NORWAY

Oslo

47whitesun1@myledonline.com

AUSTRIA

Vienna

431whitesun1@myledonline.com

NETHERLAND

Amsterdam

3120whitesun1@myledonline.com

SWITZERLAND

Zurich

4144whitesun1@myledonline.com

TURKEY

Istanbul

90216whitesun1@myledonline.com

BELGIUM

Brussels

322whitesun1@myledonline.com

SWEDEN

Stockholm

468whitesun1@myledonline.com

HUNGARY

Budapest

361whitesun1@myledonline.com

SCOTLAND

Glasgow

44141whitesun1@myledonline.com

ICELAND

Reykjavik

354whitesun1@myledonline.com

SWITZERLAND

Zurich

4144whitesun1@myledonline.com

TURKEY

Istanbul

90216whitesun1@myledonline.com

BELGIUM

Brussels

322whitesun1@myledonline.com

SWEDEN

Stockholm

468whitesun1@myledonline.com

HUNGARY

Budapest

361whitesun1@myledonline.com

SCOTLAND

Glasgow

44141whitesun1@myledonline.com

ICELAND

Reykjavik

354whitesun1@myledonline.com